As March draws to a close, polyofefin prices in Türkiye remain on a downward slide due to sluggish demand covering the PP and PE markets. Quotes fell on lack of activity, with cash flow issues and a lull due to the Ramadan holiday taking center stage.

Late deliveries of shipments from Russia and the US coupled with the restart of factories in the Middle East added pressure to sellers as they entered the second quarter. In addition, activity faltered before the election. May and the underperforming global PE market also contributed to the tension.

PP sellers in the Middle East announce discounts

Import PPH prices were affected by some quotes from Asia in the second half of March as attractive returns in Turkey attracted occasional quotes from Malaysia, China and South Korea. Market participants were not surprised by increased pressure from new factories in China and weaker-than-expected demand recovery in the region. The arbitrage window from China opened, leading to attractive deals for PP raffia and Malaysian injection duty-free reaching $1,150/ton CIF, while other origins lacked competitiveness.

Demand concerns as well as the restart of some PP mills have prompted Saudi sellers to lower prices in Turkey, although prices in Asia are not exactly competitive. Some market participants pointed to pressure from a drop in freight rates from Saudi Arabia to Turkey, which reached around $40-50/ton.

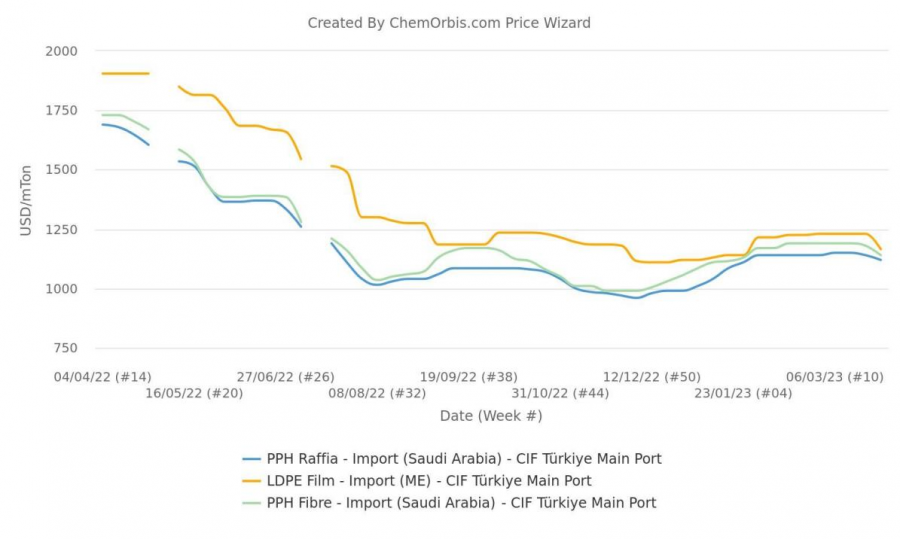

Prices of PP raffia and fibre, injection Saudi Arabia are estimated to decrease by 20-40 USD/ton compared to last week, reaching 1110-1130 USD/ton and 1130-1160 USD/ton CIF Turkey, respectively, subject to tax 6.5%. Several market participants said this weekend: “Price below $1100/tonne started to be discussed as unpromising final demand continued to drive bids lower.”

Pressure on LDPE becomes prominent

Although April PE quotes in the Middle East have not been officially announced, LDPE prices have begun to be discussed with marked reductions, succumbing to Petkim's competitive pricing.

LDPE prices are estimated to be down 60-70 USD/ton from last week to 1150-1180 USD/ton CIF Turkey, subject to 6.5% tax based on new quotes from a regional supplier. Nominal prices are down 20 USD/ton, at 1140-1160 USD/ton for LLDPE C4 film and 1180-1200 USD/ton for HDPE film ahead of upcoming announcements.

Many market participants said: "LDPE has been under heavy pressure due to relentless discounts from local producer, Petkim, not to mention shipments expected to be delivered in early Q1 and consumer demand. low final consumption.”

Shipments delivered from Russia and the US have added pressure

Late deliveries from Russia and the US arrived while the warehouses in Mersin were filled. Fast delivery LDPE prices fell, reaching 1130-1180 USD/ton FCA, subject to 6.5% tax, while LLDPE and HDPE of the same origin were offered at 1150-1160 USD/ton in the same manner.

Similarly, PP market participants have started receiving January shipments after several delays. One of them said: "Although the major producer has not yet announced new spot quotes, the express market already has enough supply of this origin in the lower end of the domestic market."

PP and PE tend to decrease in price in April

Going forward, polyolefin prices continue to decline as demand pressure weakens due to economic challenges. Aside from weak domestic fundamentals, including a quiet period during Ramadan, tight liquidity and ample supply, signals from other major markets have reinforced this view.

China PP and PE markets remained stable or slightly decreased this week. The impact of subdued demand in the derivatives segments and capacity additions prevailed despite rising Dalian futures market prices as well as relative stability in Asian oil futures and olefins. Similarly, the approaching Easter holiday coupled with a prolonged recession has put pressure on Europe, where market participants expect April monomer contracts to fall month-on-month.

According to weekly average data from ChemOrbis, import prices in Turkey may continue to fall, as the gap with China remains high due to recent price drops. Recent Middle East prices have a difference of $125/ton for LDPE, $175/ton for LLDPE, $195/ton for HDPE and $180/ton for homo PP compared to import prices in China.

Source: Vietnam Plastic Association